impossible foods ipo price

The company held a 146 billion valuation at the time. The most recent deal valued the company.

Exclusive Impossible Foods In Talks To List On The Stock Market Sources Reuters

Grow your portfolio in the pre-IPO market via OurCrowd.

. According to the company it observes animal products at the molecular level and. Grow your portfolio in the pre-IPO market via OurCrowd. Impossible has tapped into a growing hunger for its better burger.

Went public in October and shares are up 90 in its first few months as a public company. Ad Join 192000 registered investors worldwide gaining access to the pre-IPO market. Invest in proven private Tech companies before they IPO.

Ad Join 192000 registered investors worldwide gaining access to the pre-IPO market. Invest in proven private Tech companies before they IPO. As always make sure.

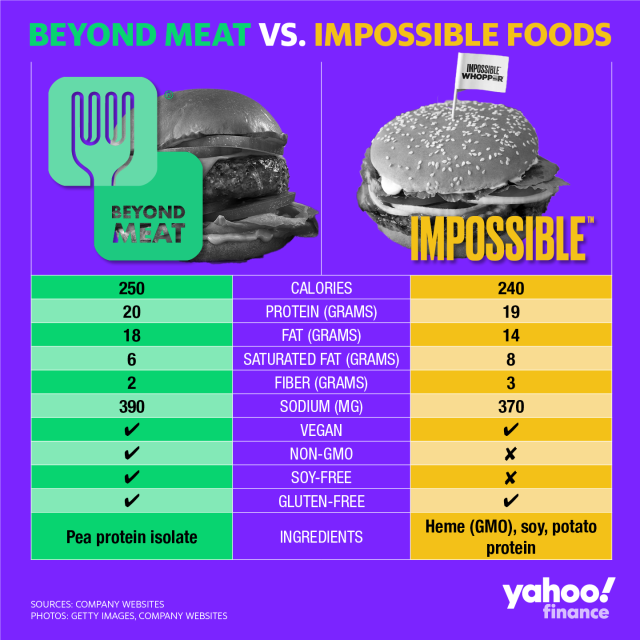

PTLO Free Alerts. Impossible Foods is a provider of plant-based burgers created to sell wholesome food directly from plants. As you probably know Beyond Meat went public in mid-2019 raising about 240 million on a valuation of 15 billion.

Beyond Meat went public at 15 billion valuation but it popped to 13 billion just three months later. No Hidden Fees or Trade Minimums. Buy Impossible Foods After the Impossible Foods IPO.

That number and the number of shares offered in the IPO will determine the actual stock price on the market. Ad Navigate the new private market with ease and buy shares in late-stage private companies. Andreessen Horowitz BlackRock Canada Pension Plan T.

Develops plant-based substitutes for meat and dairy products. Ad Navigate the new private market with ease and buy shares in late-stage private companies. Despite an impressive IPO in 2019 and subsequent few months Beyond Meats share price was trading below its initial listing price as of March 2022.

WeWork wound up being exposed as junk before its IPO. Shares of rival Beyond Meat Inc are trading more than 400 above its IPO price from 2019. 3 Mins Read.

If Impossible Foods chooses to pursue an IPO it will join a growing number of publicly traded plant-based companies. Impossible Foods latest funding round gave it a. The companys plant-based burgers.

Impossible Foods is reportedly looking to raise 500 million in a new funding round that would bring its valuation to 7 billion. The stock still trades below its IPO price of 35 per share. No Hidden Fees or Trade Minimums.

Current estimates place Impossible Foods value at 10 billion or higher. Sweetgreens anticipated IPO will be the latest in a surge of new food listings most of them disappointing. Swiss-bank UBS estimated a few years ago that plant-based food sales would rise from 46 billion in 2018 to.

Despite an impressive IPO in 2019 and subsequent few months Beyond Meats share price was trading below its initial listing price as of March 2022. Photo courtesy of Impossible. We vet new startups every month.

The IPO market saw record listings and capital raised in 2021. Impossible Foods archrival Beyond Meat made its public debut in a 240 million IPO in May 2019. Impossible Foods Chief Financial Officer David Lee stepped down earlier this.

One restaurant company set to go public in 2022 is Panera. Get free access today. In November Impossible Foods secured 500 million in funding bringing its total raise to nearly 2 billion since its founding in 2011.

Shares were floated at 25each. Ad Trade New Stocks at TD Ameritrade. Impossible Foods Chief Financial Officer David Lee stepped down earlier this year.

Impossible Foods hasnt officially announced plans to be publicly traded. Impossible Foods is reportedly looking to raise another US 500 million in new funding round and that is expected to increase its valuation to US 7 billion. Popular plant-based meat maker Impossible Foods is exploring going public at a 10 billion valuation sources told Reuters.

Get free access today. The reports come as the Silicon Valley. Since acquiring pre-IPO shares is usually reserved for wealthy investors the most likely way youll ever own the stock is.

We vet new startups every month. On April 8 2021 Impossible Foods a plant-based meat substitute manufacturer and a competitor of Beyond Meat is preparing to go public Reuters reported citing unnamed sources. Impossible Foods Inc.

Ad Trade New Stocks at TD Ameritrade. But in early 2021 Reuters reported that Impossible Foods was angling to go public at a 10 billion. 400 higher than its IPO price in 2019.

In the decade before Beyond Meat went public in 2019 just five food. The Impossible Foods IPO is expected to be worth 10 billion. In May 2019 Beyond Meat made history when it.

Shares of rival Beyond Meat Inc BYNDO are trading more than 400 above its IPO price from 2019.

Impossible Foods Taps Top Chobani Executive As Its New Ceo

/cdn.vox-cdn.com/uploads/chorus_asset/file/16257256/impossible_burger_300_million.jpg)

Impossible Burger And Beyond Meat Burgers Will Come To The U K Soon Eater London

Exclusive Impossible Foods In Talks To List On The Stock Market Sources Reuters

Impossible Foods Reportedly Preparing For Ipo With Us 10 Billion Valuation

Impossible Foods Stock Prepare To Invest In The Ipo

Former Chobani Executive To Take Reins At Impossible Foods

Impossible Foods Ipo How To Invest In Impossible Foods Vegpreneur

Impossible Foods Ipo Plant Based Food Giant Eyes 2022 Listing

Report Impossible Foods Eyes 10b Ipo Valuation Food Manufacturing

Impossible Foods Prepping To Go Public At 10bn Valuation Report

Impossible Foods Eyes 7b Valuation Founder Hints At Inevitable Ipo

Impossible Foods Ipo What You Need To Know Forbes Advisor

Why Impossible Foods Viability In Asia Is Key To Its Highly Anticipated Ipo

Impossible Foods Others Use Partners To Expand Chicago News Wttw

Impossible Foods Ipo Stock Analysis Buy Or Sell Youtube

Impossible Foods This Could Be The Best Tech Ipo Of 2020

Impossible Foods Eyes 7b Valuation Founder Hints At Inevitable Ipo

Impossible Foods Eyes Doubling Valuation With New Funding Sources Say